Loading blog post...

Privacy Coins in 2026: Technology, Regulation and Adoption

In 2026, privacy is no longer a fringe crypto experiment, it's a foundational requirement for global finance. As public ledgers become more surveilled, privacy coins like Monero and Zcash are evolving from tools of anonymity into sophisticated shields for corporate and personal confidentiality. This guide breaks down the cryptographic innovations and regulatory shifts defining the future of private digital cash.

Privacy has quietly become one of the most contested ideas in crypto. While transparency was once the defining promise of blockchain, real-world usage has exposed its limits. Public ledgers are powerful but they are also permanent, traceable, and increasingly surveilled.

This is why privacy coins continue to exist, evolve, and polarize opinion.

As we move into 2026, the conversation around privacy coins is no longer just about ideology. It’s about cryptographic innovation, regulatory pressure, and whether private transactions can coexist with global compliance frameworks.

This guide explores where privacy coins stand today - technically, legally and socially, and what that means for their future.

What Privacy Coin Meaning Has Evolved Into

Early discussions around privacy coins framed them as tools for anonymity. In reality, their purpose is more nuanced.

A privacy coin focuses on transactional confidentiality. That includes hiding:

- sender identity

- receiver identity

- transaction amount

Unlike transparent blockchains, privacy-first networks aim to replicate the discretion of cash in a digital environment.

Understanding this distinction is key when evaluating any privacy coin list. Not all privacy coins use the same cryptographic methods, and not all offer the same level of protection.

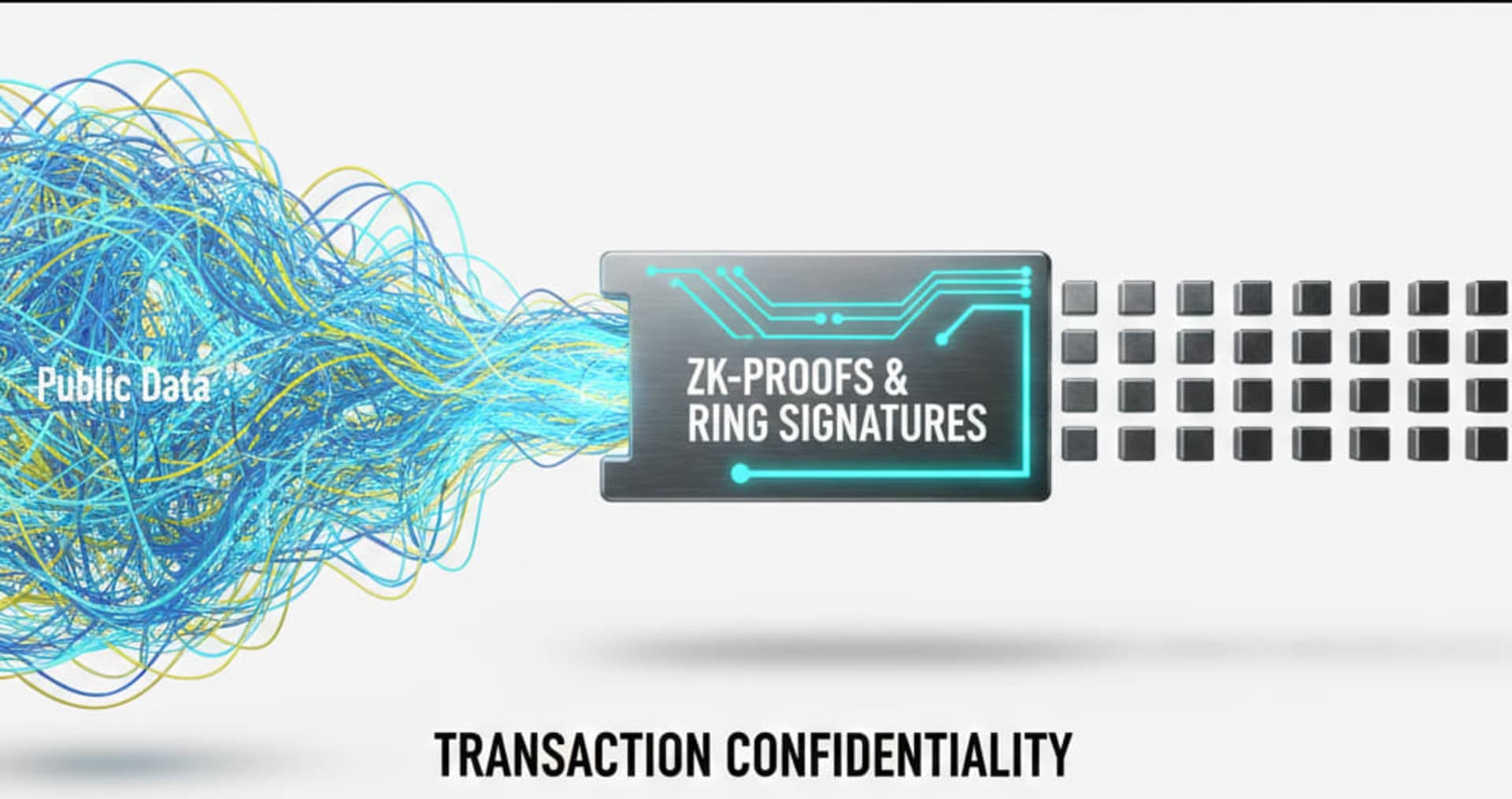

The Cryptographic Technology Powering Privacy Coins

Modern privacy coins rely on advanced cryptography rather than simple obfuscation. Over time, these technologies have matured significantly.

Common techniques include:

- ring signatures

- zero-knowledge proofs

- confidential transactions

Each approach balances privacy, scalability, and auditability differently. For example, Monero continues to emphasize strong default privacy, while Zcash allows optional shielding. Projects like Beam and Grin focus on lightweight, scalable confidentiality.

Here, pointers help clarify the trade-offs:

Privacy technology impacts:

- transaction size

- network performance

- regulatory perception

This technical diversity is why a list of privacy coins should never be treated as uniform.

For teams exploring privacy-preserving architectures, our blockchain consulting services help evaluate cryptographic design choices. Get started today.

Top Privacy Coin Projects Still Shaping the Space

Despite regulatory pressure, several projects remain influential within the privacy ecosystem.

Coins often referenced in a top privacy coin or top 10 privacy coins discussion include:

- Monero

- Zcash

- Dash

- Verge

- Pirate Chain

- Beam

- Grin

Each represents a different philosophy. Dash and Verge focus on optional privacy layers, while Pirate Chain enforces privacy by default. Grin pricing and adoption trends reflect its minimalist, community-driven approach.

This diversity explains why no single privacy coin list fits every use case.

Regulatory Pressure Is Redefining Privacy Coin Adoption

By 2026, regulation is the biggest variable affecting privacy coins.

Governments are increasingly concerned about:

- illicit finance

- sanctions enforcement

- tax compliance

As a result, some exchanges have delisted privacy coins, while others restrict access based on jurisdiction. This doesn’t eliminate demand—it changes how and where privacy coins are used.

Here’s where nuance matters:

Regulation affects:

- exchange availability

- institutional adoption

- developer incentives

Adoption Trends: Who Actually Uses Privacy Coins in 2026

Despite headlines, privacy coins are not disappearing. Their user base is shifting.

Adoption is increasingly driven by:

- individuals in high-surveillance regions

- businesses seeking transactional confidentiality

- privacy-focused communities

Rather than mass-market speculation, usage is becoming more purpose-driven. This shift explains why privacy coins may not dominate trading volume but remain culturally and technically relevant.

This evolution challenges simplistic rankings like “top 10 privacy coins” based solely on market cap.

Privacy Coins vs Transparent Blockchains: A False Dichotomy

The future is not purely private or purely transparent. Increasingly, blockchain ecosystems are hybrid.

Some projects explore:

- selective disclosure

- auditable privacy

- compliance-friendly privacy layers

This convergence suggests that privacy coins are influencing broader blockchain design, even beyond their own ecosystems.

Market Reality: Why Privacy Coin Prices Don’t Tell the Full Story

Market performance is often misunderstood in this segment. Metrics like Grin pricing or short-term price action fail to capture real adoption.

Privacy coins tend to prioritize:

- long-term resilience

- decentralized development

- ideological consistency

This makes them less responsive to hype cycles but more resistant to sudden collapse. Evaluating privacy coins requires a different lens than speculative assets.

FAQ: Privacy Coins Explained

Q: What are privacy coins?

A: Cryptocurrencies designed to hide transaction details.

Q: Are privacy coins illegal?

A: Not universally, but regulations vary by country.

Q: Is Monero still relevant in 2026?

A: Yes, due to strong default privacy and community support.

Q: Why do some exchanges delist privacy coins?

A: Due to compliance and regulatory concerns.

Q: Do privacy coins have a future?

A: Yes, but adoption will be more targeted than mass-market.

Conclusion

Privacy coins occupy a unique and often misunderstood position in crypto. In 2026, they are no longer fringe experiments or speculative novelties, they are specialized tools responding to real-world needs for confidentiality.

While regulation continues to shape their accessibility, the underlying demand for private transactions has not disappeared. Projects like Monero, Zcash, Dash, Verge, Pirate Chain, Beam, and Grin illustrate that privacy is not a single solution, but a spectrum of approaches. From an infrastructure perspective, teams like EthElite view privacy not as an add-on feature, but as a design choice that must be engineered deliberately within broader blockchain systems.

As blockchain adoption grows globally, privacy coins will remain relevant not because they dominate markets, but because they defend a principle that digital systems still struggle to balance: the right to transact without being watched.

Share with your community!