Loading blog post...

5 Common Factors Behind Why Most Memecoins Crash

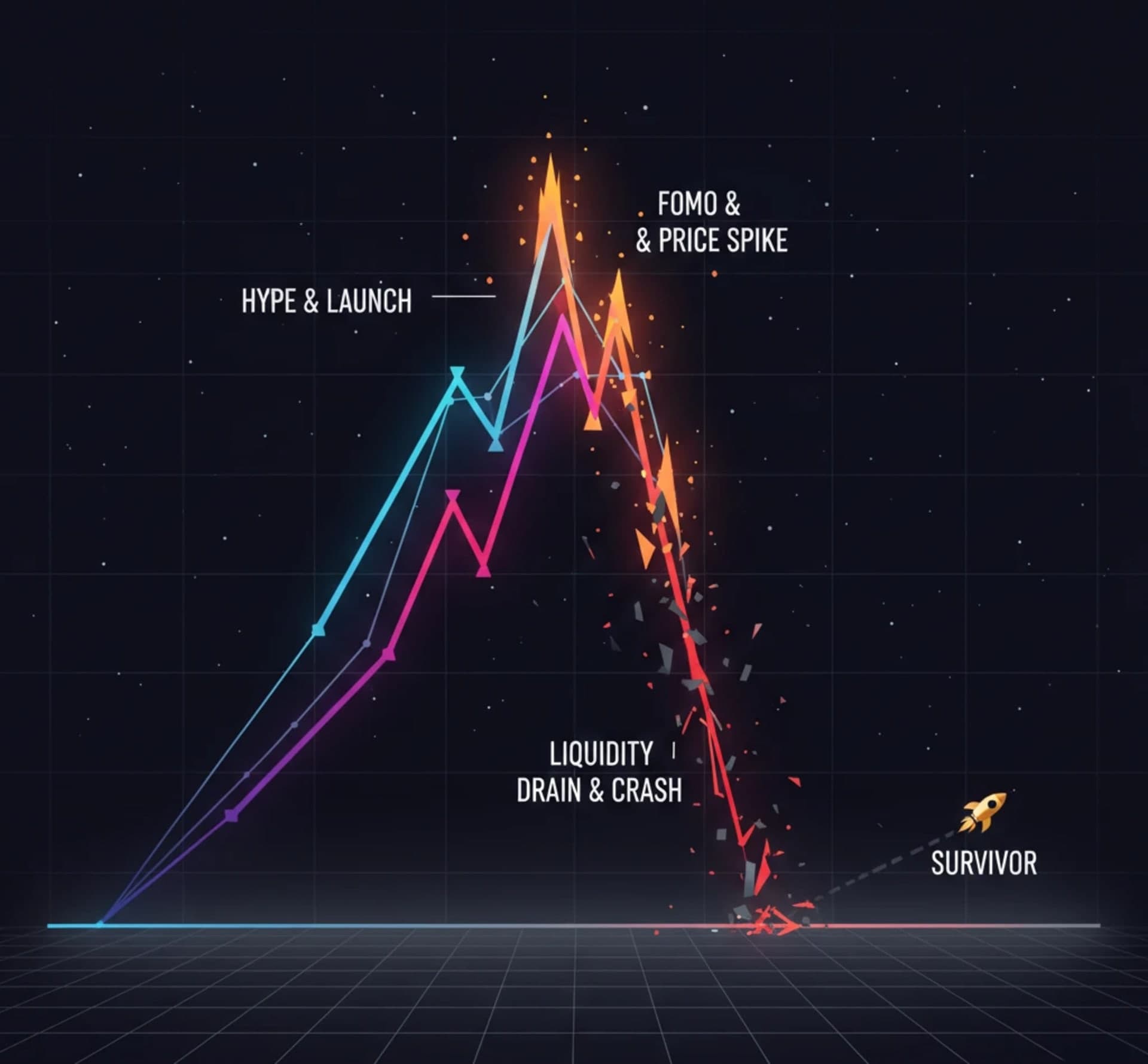

Memecoins are the ultimate high-stakes game of internet culture, but why do 99% of them end in a total price collapse? It’s rarely 'bad luck.' From 'ghost-town' communities to technical vulnerabilities that act as ticking time bombs, most memecoin crashes are structural. This guide pulls back the curtain on the five systemic reasons why even the most hyped tokens fail, helping you separate temporary virality from long-term survival.

Memecoins have carved out a strange but powerful niche in the crypto ecosystem. Born from internet culture, humor, and collective momentum, memecoins often generate massive attention in a short time. Every cycle introduces new meme coins, viral launches, and bold predictions about the next breakout token.

Yet when you look at any top meme coins list from previous years, a harsh pattern emerges: most memecoins don’t survive. Their meme coin price spikes briefly, then collapses, sometimes within weeks.

Understanding meme coin meaning beyond jokes is essential. A memecoin is still a crypto asset governed by market structure, token design, community behavior, and technical integrity. When these fundamentals are weak, collapse is not accidental, it’s structural.

This guide explores the deeper, systemic reasons why most crypto meme coins crash, helping investors and builders separate short-term hype from long-term survivability.

1. Hype-Centric Launches With No Reason to Exist After the Trend Peaks

The most common failure point for a meme coin is that it exists only to ride a moment. Launch narratives are often built around humor, pop culture references, or social media virality but nothing beyond that.

During the initial hype phase, demand pushes the meme coin price upward. Influencers amplify exposure, communities grow rapidly, and the token may even appear on a top meme coins list. But once attention shifts, the core question emerges: why should anyone keep holding this meme token?

Here’s where pointers clarify the root problem:

Most failed memecoins lack:

- functional use cases

- integrations with blockchain applications

- any reason to transact beyond speculation

Without utility, demand depends entirely on new buyers entering the market. When that flow slows, liquidity collapses and prices follow.

For teams trying to move beyond hype cycles, our blockchain consulting services help align token narratives with real functionality. Get a free consultation today.

2. Flawed Tokenomics Behind Many “Meme Coins That Will Explode”

Phrases like meme coins that will explode, best meme coin to buy, or cheap meme coins often hide poor token design. Many memecoins are structured to pump quickly, not to last.

Common tokenomic flaws include:

- excessive total supply

- concentrated insider allocations

- aggressive vesting unlocks

These designs create artificial scarcity early, pushing tokens into top meme coins conversations. But once early holders begin selling, the imbalance becomes visible.

This is why scanning a meme coin list without understanding distribution is dangerous. A low token price does not mean upside, it often signals dilution risk.

For sustainable design, our token design services focus on long-term balance rather than short-term hype.

3. Community Momentum That Collapses After Early Speculation

Memecoins live and die by community energy. But not all communities are equal.

Many upcoming meme coins attract large followings quickly through airdrops, giveaways, and influencer campaigns. When rewards stop, engagement disappears.

Healthy communities:

- create content organically

- defend the project narrative

- adapt when market conditions change

Speculative communities, by contrast, exist only to ask one question: when moon?

Once that question goes unanswered, even tokens labeled as best meme coins struggle to maintain relevance.

For projects building beyond speculation, our Web3 social media management services help structure long-term community engagement.

4. Weak Technical Foundations That Destroy Trust Overnight

Technical weakness is a silent killer of meme coin crypto projects. Many memecoins are deployed with minimal engineering, no audits, and unsafe permissions.

Common red flags include:

- centralized minting authority

- unrestricted upgrade functions

- unaudited or copy-pasted contracts

These vulnerabilities often go unnoticed during hype phases. But once discovered, confidence evaporates instantly. Even tokens listed in top meme coins list rankings can crash within hours after technical flaws surface.

For teams taking security seriously, our smart contract audit services help identify risks before launch.

5. Misleading Narratives Around “Best Meme Coin to Invest”

Search terms like best meme coin to invest, meme coins to buy, or buy meme coin imply certainty where none exists. This mindset itself fuels volatility.

When large numbers of buyers enter with unrealistic expectations, markets become fragile. A small correction triggers panic selling, accelerating decline.

Here’s where pointers ground reality:

Memecoins are:

- sentiment-driven

- highly sensitive to liquidity shifts

- vulnerable to sudden narrative changes

This doesn’t mean every memecoin is doomed. But treating every meme coin website as a guaranteed opportunity ensures repeated losses.

Why Most Meme Coins Never Reach Long-Term Relevance

Looking across all meme coin list data over multiple cycles reveals a pattern: very few memecoins evolve beyond their initial joke.

Those that survive usually:

- develop secondary use cases

- maintain consistent community leadership

- adapt narratives without abandoning identity

The majority do not. They remain static while markets move on.

Understanding this difference is crucial when evaluating newest crypto coins entering the memecoin category.

FAQ: Understanding Why Memecoins Crash

Q: What is a meme coin?

A: A cryptocurrency inspired by internet culture, often community-driven and narrative-heavy.

Q: Why do most meme coins fail?

A: Because they lack utility, sustainable tokenomics, or long-term community engagement.

Q: Are there any good meme coins to buy?

A: Some survive longer due to strong communities and evolving use cases, but risk remains high.

Q: Does low meme coin price mean higher upside?

A: No. Price alone does not indicate value or sustainability.

Q: How can I evaluate meme coins better?

A: Look beyond hype, analyze tokenomics, technical design, and community behavior.

Conclusion

Memecoins don’t collapse because they lack humor. They collapse because most are launched without structure. Short-term hype, poorly thought-out tokenomics, thin community alignment, and weak technical foundations create systems that break the moment attention shifts elsewhere.

Only a small fraction of crypto meme coins manage to transition from momentum to sustainability. The rest fade once incentives dry up. Recognizing these failure patterns matters not just for investors, but for builders who want to create meme projects with actual longevity. This is the layer EthElite operates in, where design discipline, contract robustness and incentive alignment matter more than virality.

In the memecoin economy, endurance isn’t about volume. It’s about the token architecture.

Share with your community!