Loading blog post...

Why Gold Tokenization Is Becoming a Core Asset Class in 2026

By 2026, gold tokenization has evolved from a niche concept into foundational financial infrastructure. Discover how transforming static physical bars into liquid, on-chain tokens is unlocking unprecedented utility, real-time settlement, and global accessibility for investors and institutions alike, moving gold beyond just a store of value into a programmable financial primitive.

Gold has survived every financial cycle because it represents trust without dependency. But for decades, gold has also suffered from a major limitation: liquidity friction. Storage costs, settlement delays, jurisdictional barriers, and lack of programmability made gold difficult to move at the speed of modern markets.

That’s changing fast.

In 2026, gold tokenization will be emerging as a core asset class, bridging the stability of physical gold with the efficiency of blockchain infrastructure. By converting gold into a cryptographic token, markets unlock global accessibility, real-time settlement and programmable ownership without sacrificing trust.

This is not a speculative experiment. It’s a structural shift in how one of the world’s oldest assets functions.

Gold Tokenization Transforms a Static Asset Into a Liquid, Digital Primitive

Traditional gold ownership is slow by design. Even “digital gold” products rely on centralized databases and delayed settlement. Gold tokenization changes this by representing verified physical gold as on-chain units that can move instantly.

With tokenized gold, ownership becomes:

- divisible into precise fractions

- transferable in real time

- globally accessible without intermediaries

- auditable through cryptographic proofs

This transforms gold from a passive store of value into a digitally active asset.

Why Tokenized Gold Fits Perfectly Into Modern Portfolio Design

Investors aren’t replacing gold, they’re just upgrading how they access it. Tokenized gold slots naturally into both traditional and crypto-native portfolios, acting as a volatility hedge with blockchain-native mobility.

Its advantages over paper gold include:

- direct ownership representation

- transparent backing mechanisms

- instant settlement without clearing delays

- compatibility with decentralized finance systems

This evolution positions gold not as “old money,” but as programmable collateral in a modern financial stack.

The Role of Cryptographic Tokens in Verifying Gold Ownership

At the core of gold tokenization lies the cryptographic token, a digital construct that represents verifiable ownership without requiring trust in a central ledger.

A properly designed cryptographic token ensures:

- one-to-one backing with physical reserves

- immutable issuance records

- transparent transfer history

- programmable compliance rules

This removes ambiguity from gold ownership and replaces it with math, code, and verifiability.

If you’re designing secure token standards, our smart contract-backed token systems cover these mechanics in detail, so contact us now.

How Tokenization Improves Gold Market Liquidity Without Increasing Risk

Gold markets have always been liquid at scale, but inefficient at the individual level. Tokenization solves this by enabling fractional participation without introducing leverage or synthetic exposure.

Here, pointers help clarify impact:

Tokenization improves liquidity by enabling:

- fractional ownership for smaller investors

- 24/7 global trading access

- instant settlement instead of delayed clearing

- direct peer-to-peer transfers

Liquidity increases not because demand becomes speculative, but because barriers to participation disappear.

Why Institutions Are Treating Gold Tokenization as Infrastructure, Not Trend

In 2026, institutions aren’t experimenting with tokenized gold—they’re integrating it. The appeal lies not in yield, but in infrastructure efficiency: faster settlement, lower custody overhead, and transparent reconciliation.

Institutions value gold tokenization because it offers:

- auditability without manual reconciliation

- reduced counterparty exposure

- seamless cross-border transfers

- programmable compliance enforcement

Gold becomes easier to manage at scale without sacrificing its conservative risk profile.

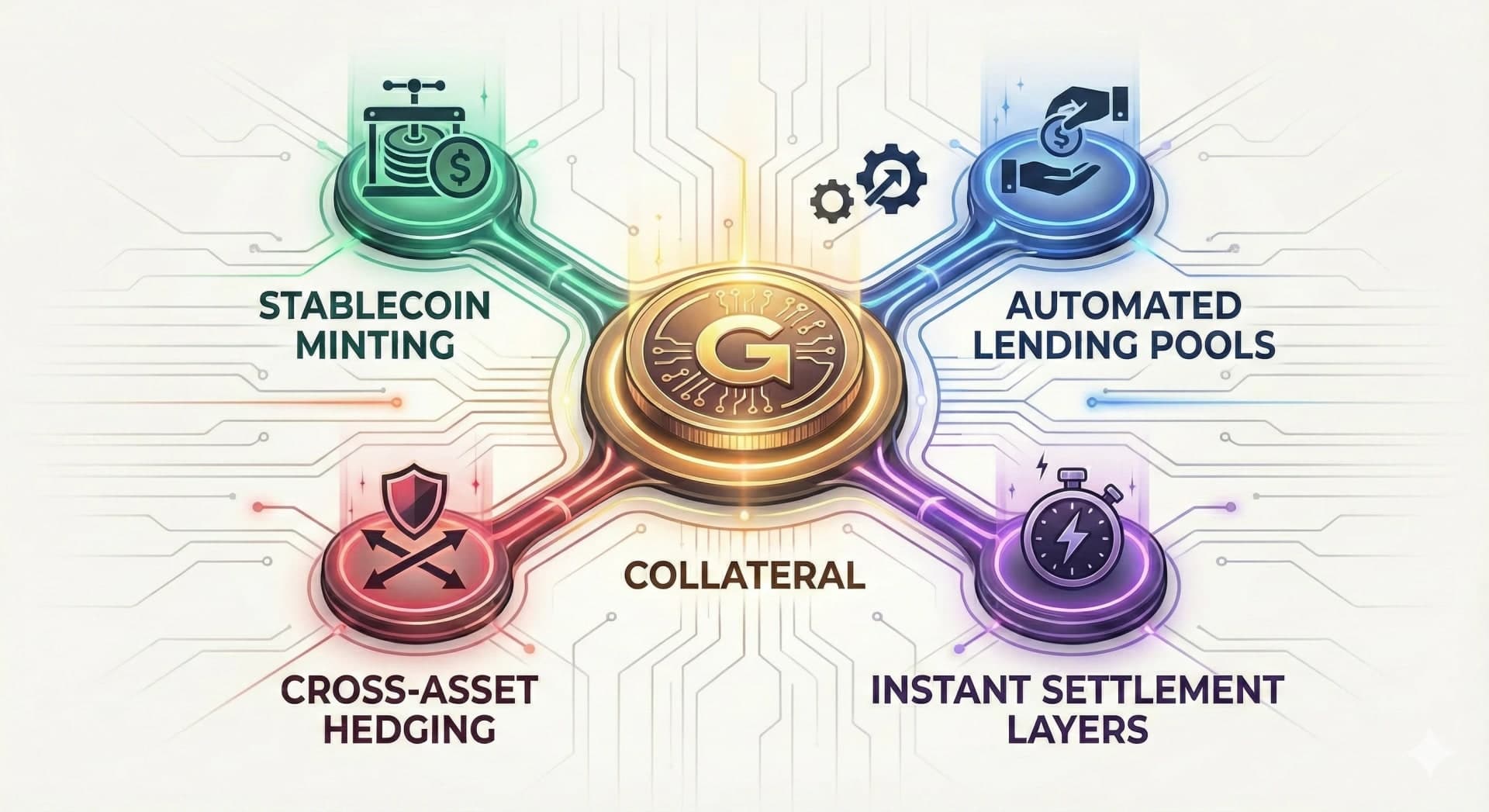

Tokenized Gold as Collateral in On-Chain Financial Systems

One of the most important shifts in 2026 is gold’s role inside decentralized finance. Once tokenized, gold can function as neutral, non-sovereign collateral—without relying on volatile crypto assets alone.

This unlocks use cases such as:

- collateralized lending

- stable asset pools

- cross-asset hedging strategies

- programmable settlement instruments

Gold’s stability combined with blockchain’s automation makes it uniquely suited for trust-minimized finance.

FAQ: Gold Tokenization Explained

Q: What is gold tokenization in simple terms?

A: It’s the process of representing physical gold as blockchain-based tokens backed by verified reserves.

Q: Is tokenized gold the same as paper gold?

A: No. Tokenized gold represents direct, verifiable ownership, not a derivative claim.

Q: Why use a cryptographic token instead of a database record?

A: Because cryptographic tokens are immutable, transparent, and transferable without intermediaries.

Q: Does tokenization increase gold’s risk profile?

A: No. It increases accessibility and liquidity while preserving gold’s underlying stability.

Q: Can tokenized gold be used in DeFi?

A: Yes. That’s one of its strongest advantages in 2026.

Conclusion

Gold tokenization isn’t about reinventing gold but about removing the friction that has held it back in modern markets. By combining physical trust with digital efficiency, tokenized gold becomes more usable, more accessible and more liquid without losing its core identity.

As 2026 unfolds, gold tokenization is no longer an experiment. It’s becoming foundational infrastructure for the next generation of asset markets.

Share with your community!