Loading blog post...

How Modern NFT Marketplaces Balance Liquidity, Royalties, and UX

In 2026, NFT marketplaces have evolved from experimental art galleries into sophisticated financial ecosystems. The most resilient platforms no longer choose between high volume and creator sustainability; instead, they operate at the intersection of liquidity, protocol-enforced royalties, and frictionless user experience. This exploration breaks down the architectural decisions that define the modern crypto marketplace and why trust, not hype is now the primary currency for long-term relevance.

NFT marketplaces have now matured beyond mint-and-list platforms. In today’s Web3 ecosystem, a successful nft marketplace sits at the intersection of three often competing forces: liquidity, creator royalties, and user experience. Optimizing one at the expense of the others no longer works.

The most successful nft marketplaces in 2026 behave more like financial products than experimental art platforms. They function as sophisticated crypto marketplaces, where trading efficiency, creator sustainability, and intuitive UX must coexist without undermining each other.

This blog explores how modern NFT marketplaces strike that balance, and what separates short-lived nft platforms from those that achieve long-term relevance.

Liquidity as the Foundation of Any Scalable NFT Marketplace

Liquidity is the lifeblood of every nft marketplace. Without consistent buying and selling activity, even the most visually polished platform becomes irrelevant. Modern marketplaces focus heavily on reducing friction at the moment of trade.

Liquidity isn’t just about volume, it’s about confidence too. Users need to believe that assets can be sold at fair prices without excessive delays.

Well-designed nft marketplaces improve liquidity by:

- simplifying listing and delisting flows

- surfacing realistic floor prices

- reducing unnecessary transaction steps

- ensuring predictable settlement

In practice, liquidity improvements often come from better product decisions, not aggressive incentives.

See our NFT marketplace development services focus heavily on liquidity-aware design.

Why Creator Royalties Remain a Core Design Challenge for NFT Platforms

Royalties are one of the most debated aspects of the modern nft platform. Creators rely on them for long-term sustainability, while traders often view them as friction.

The strongest nft marketplaces avoid extreme positions. Instead of enforcing rigid royalty structures or abandoning them entirely, they design systems that align incentives across participants.

Balanced royalty models typically:

- make royalty logic transparent

- avoid surprise costs at checkout

- allow flexibility without exploitation

- reflect creator intent clearly

Royalties work best when users understand why they exist, not when they’re hidden or imposed unexpectedly.

UX Is the Differentiator in an Increasingly Crowded Crypto Marketplace

As NFT trading has expanded, UX has become the defining differentiator. Today’s users interact with multiple crypto marketplaces regularly, tolerance for friction is extremely low.

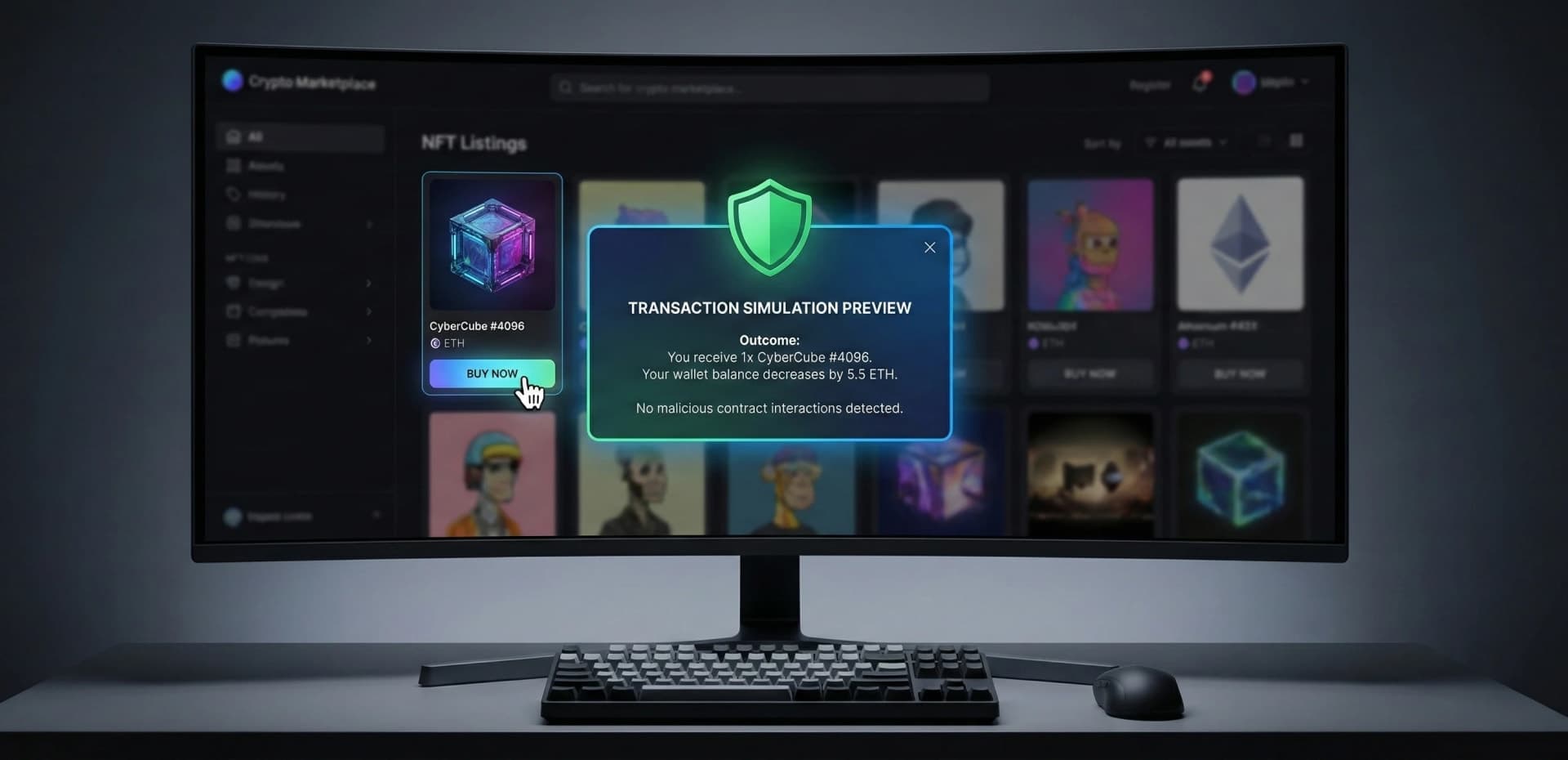

A modern nft marketplace UX prioritizes clarity over novelty. Users care less about animations and more about knowing exactly what will happen when they click “Buy” or “List.”

Effective UX decisions often show up as:

- clear transaction previews

- readable pricing and fees

- obvious ownership status

- minimal cognitive load

The best nft platforms don’t require users to “learn the platform” — they behave predictably from the first interaction.

For user-centered marketplace UX, our Web3 UX design services focus on reducing decision friction. Talk to our experts.

Balancing Secondary Market Activity Without Undermining Trust

Secondary trading is where most liquidity lives in NFT marketplaces. However, unchecked speculation can quickly erode trust, especially when users feel manipulated by sudden price swings or opaque mechanics.

Modern nft marketplaces use subtle controls to encourage healthier secondary markets without restricting freedom.

These controls may include:

- clearer historical price context

- reduced emphasis on short-term flipping signals

- better visibility into asset provenance

- safeguards against wash trading

These aren’t limitations, they’re trust mechanisms that support a sustainable nft marketplace ecosystem.

Infrastructure Decisions Quietly Shape UX and Liquidity Outcomes

While users don’t see infrastructure directly, its impact is felt everywhere. Downtime, delayed updates, or inconsistent state all damage confidence.

Mature nft marketplaces invest in infrastructure that supports:

- real-time asset updates

- predictable transaction states

- consistent availability during traffic spikes

This reliability is essential for liquidity. Traders don’t return to platforms they can’t trust during peak demand.

Marketplace Credibility Comes From Behavioral Signals, Not Marketing

In a crowded market, credibility is earned through behavior. Users quickly recognize which nft platforms behave reliably and which rely on hype.

Trusted nft marketplaces exhibit:

- calm communication during issues

- transparent fee structures

- consistent interface behavior

- conservative feature rollouts

These behavioral signals matter more than aggressive growth tactics in the long run.

Why the Best NFT Marketplaces Design for Long-Term Ecosystems

The most resilient nft marketplaces design for years, not hype cycles. They expect creator needs, trader behavior, and user sophistication to evolve.

This long-term thinking often appears in:

- modular feature development

- adaptable royalty frameworks

- governance-aware policies

- ecosystem partnerships

NFT platforms that plan for evolution remain relevant even as trends shift.

FAQs

Q: Why is liquidity so critical for NFT marketplaces?

A: Because assets lose value quickly if they can’t be traded efficiently.

Q: Do royalties always reduce trading volume?

A: Not when designed transparently and aligned with user expectations.

Q: Is UX more important than features in NFT platforms?

A: Yes. Poor UX negates feature depth almost immediately.

Q: How do crypto marketplaces maintain trust?

A: Through predictable behavior, clear communication, and reliability.

Q: Can small teams build competitive NFT marketplaces?

A: Yes, with focused scope and strong product discipline.

Conclusion

Modern nft marketplaces succeed not by maximizing one metric, but by carefully balancing liquidity, royalties, and user experience. When these elements work together, platforms feel intuitive, fair, and dependable.

The strongest nft platforms are those that quietly remove friction, respect creators, and support traders without forcing users to think about the complexity underneath.

That balance is what transforms a marketplace into lasting infrastructure within the broader crypto marketplace ecosystem and it’s how EthElite builds NFT platforms meant to endure.

Share with your community!