Loading blog post...

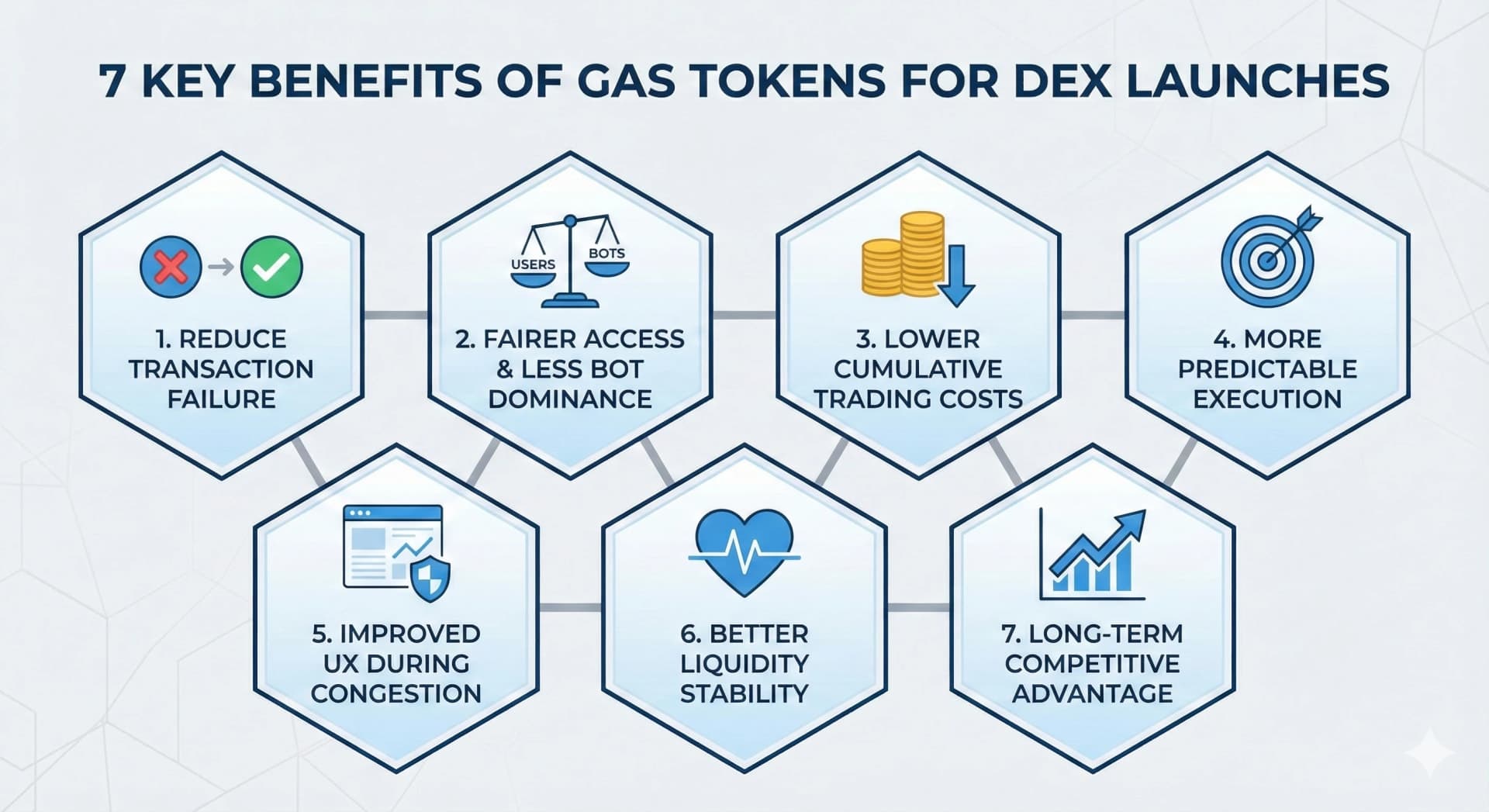

7 Key Benefits of Gas Tokens for DEX Users During High-Volume Launches

High-volume token launches are the ultimate stress test for DeFi traders. Between skyrocketing fees and failed transactions, getting an early entry can feel impossible. This guide explores how gas tokens provide a strategic edge, enabling more predictable execution, lower effective costs and fairer access on decentralized exchanges during peak congestion.

High-volume token launches have become one of the most stressful moments in the DeFi ecosystem. Whether it’s a new token launch, a new crypto coin launch or a highly anticipated memecoin drop, users flooding a DEX platform experience the same pain points: failed transactions, skyrocketing fees, missed entries, and unfair execution.

Gas tokens quietly play a critical role at this point.

On decentralized exchanges, other than reducing costs, gas tokens directly influence execution quality, access fairness, and overall market efficiency during peak congestion. As DeFi exchanges continue to handle increasingly competitive launches, understanding gas tokens has become essential for serious DEX users.

This guide breaks down the seven key benefits of gas tokens during high-volume token launches, with a focus on real user impact rather than theory.

1. Gas Tokens Reduce Transaction Failure During DEX Token Launches

During a token launch, thousands of users attempt to execute swaps at the same time. On any decentralized trading platform, this creates mempool congestion where low-priority transactions are delayed or dropped.

Gas tokens help users manage this chaos by allowing more precise control over gas expenditure. Instead of guessing fees or blindly overpaying, users with gas optimization mechanisms are more likely to get their transactions included.

This directly reduces:

- failed swaps

- wasted gas

- repeated resubmissions

For active traders on DEX platforms, fewer failures mean more reliable participation during launches.

For teams building gas-efficient launch mechanics, our smart contract development services focus heavily on gas-aware execution.

2. Fairer Access to New Token Launch Opportunities on Decentralized Exchanges

One of the biggest criticisms of top decentralized exchanges during launches is that whales and bots dominate early blocks. Gas tokens can help level the playing field by enabling more predictable execution rather than pure bidding wars.

When gas usage is optimized, smaller traders aren’t automatically pushed out by inflated fee competition. While gas tokens don’t eliminate MEV entirely, they reduce the advantage gained purely through reckless fee escalation.

This improves perceived fairness during:

- early liquidity events

- first-block swaps

- initial price discovery

Fairer access builds long-term trust in DEX ecosystems.

3. Lower Effective Costs for High-Frequency Traders on DeFi Exchanges

Active users who trade across multiple DeFi exchanges during a new crypto coin launch often pay more in gas than in slippage. Gas tokens can significantly lower cumulative costs when transactions are executed repeatedly under high load.

Rather than optimizing each transaction manually, gas-aware mechanisms smooth out costs across sessions.

This is especially valuable for:

- arbitrage traders

- liquidity providers

- launch-day market makers

Over time, reduced execution cost directly impacts profitability on any decentralized trading platform.

Reach out to EthElite for a free consultation on how cover gas-efficiency at scale for your blockchain project.

4. More Predictable Execution on DEX Platforms During Network Congestion

Unpredictability is one of the biggest risks during a token launch. Even users willing to pay higher fees often experience delayed or inconsistent execution.

Gas tokens improve predictability by allowing transactions to align better with network conditions instead of reacting blindly to congestion spikes.

Here’s where pointers help clarify the benefit:

Predictable execution means:

- fewer surprise failures

- more consistent entry prices

- better timing alignment with launch phases

This reliability is a defining feature of the best decentralized exchange experiences during high-traffic events.

5. Improved UX Across Decentralized Trading Platforms

From a user perspective, gas management is one of the most confusing aspects of interacting with a DEX. Gas tokens abstract complexity, allowing users to focus on the trade rather than fee mechanics.

Modern decentralized exchanges increasingly integrate gas-aware UX flows that:

- prevent underpriced transactions

- warn users during congestion

- optimize fees automatically

This improves usability, especially for users navigating a list of decentralized exchanges during launch events.

For teams improving DEX UX under load, our Web3 UX design services address gas friction directly. Reach out.

6. Better Launch-Day Liquidity Stability for New Token Launches

Gas inefficiency doesn’t just hurt users, it destabilizes liquidity. When transactions fail or lag, liquidity pools become uneven, spreads widen, and price discovery suffers.

Gas tokens help stabilize early liquidity by ensuring smoother transaction flow during critical launch windows. This leads to:

- tighter spreads

- healthier pools

- more accurate pricing

For new token launches, this stability benefits both traders and project teams.

For protocols planning launch infrastructure, our token launch services are designed around congestion resilience.

7. Long-Term Competitive Advantage for DEX Users Who Optimize Gas

Finally, gas tokens are not just a launch-day advantage — they compound over time. Users who understand gas mechanics consistently outperform those who don’t, especially on top decentralized exchanges where competition is relentless.

Over multiple launches and market cycles, optimized gas usage translates into:

- better execution

- lower cumulative costs

- higher net returns

On any DEX platform, this operational edge becomes increasingly meaningful as activity scales.

FAQ: Gas Tokens and DEX Token Launches

Q: Are gas tokens only useful during token launches?

A: No, but their impact is most visible during congestion-heavy events.

Q: Do gas tokens guarantee successful trades?

A: No, but they significantly improve execution probability.

Q: Are gas tokens supported by all decentralized exchanges?

A: Support varies across the list of decentralized exchanges.

Q: Do gas tokens reduce slippage?

A: Indirectly, by improving execution timing and reducing failed retries.

Q: Are gas tokens relevant for small traders?

A: Yes, especially during high-volume launches where fees spike.

Conclusion

Gas tokens aren’t a gimmick, they’re a practical execution tool for users operating in high-stakes environments on decentralized exchanges. During new token launches, where congestion and competition peak, gas optimization often decides who gets filled and who gets left behind.

Hence, EthElite factors gas dynamics directly into DEX strategy, launch planning and execution design as infrastructure.

As DeFi exchanges scale and launches become more competitive, gas-aware trading is no longer optional. It’s a core skill for anyone serious about using a DEX efficiently.

In a market where milliseconds and execution reliability matter, gas tokens quietly separate prepared traders from the rest.

Share with your community!