Loading blog post...

5 Simple Ways Tokenization Unlocks Liquidity Across Any Asset Class

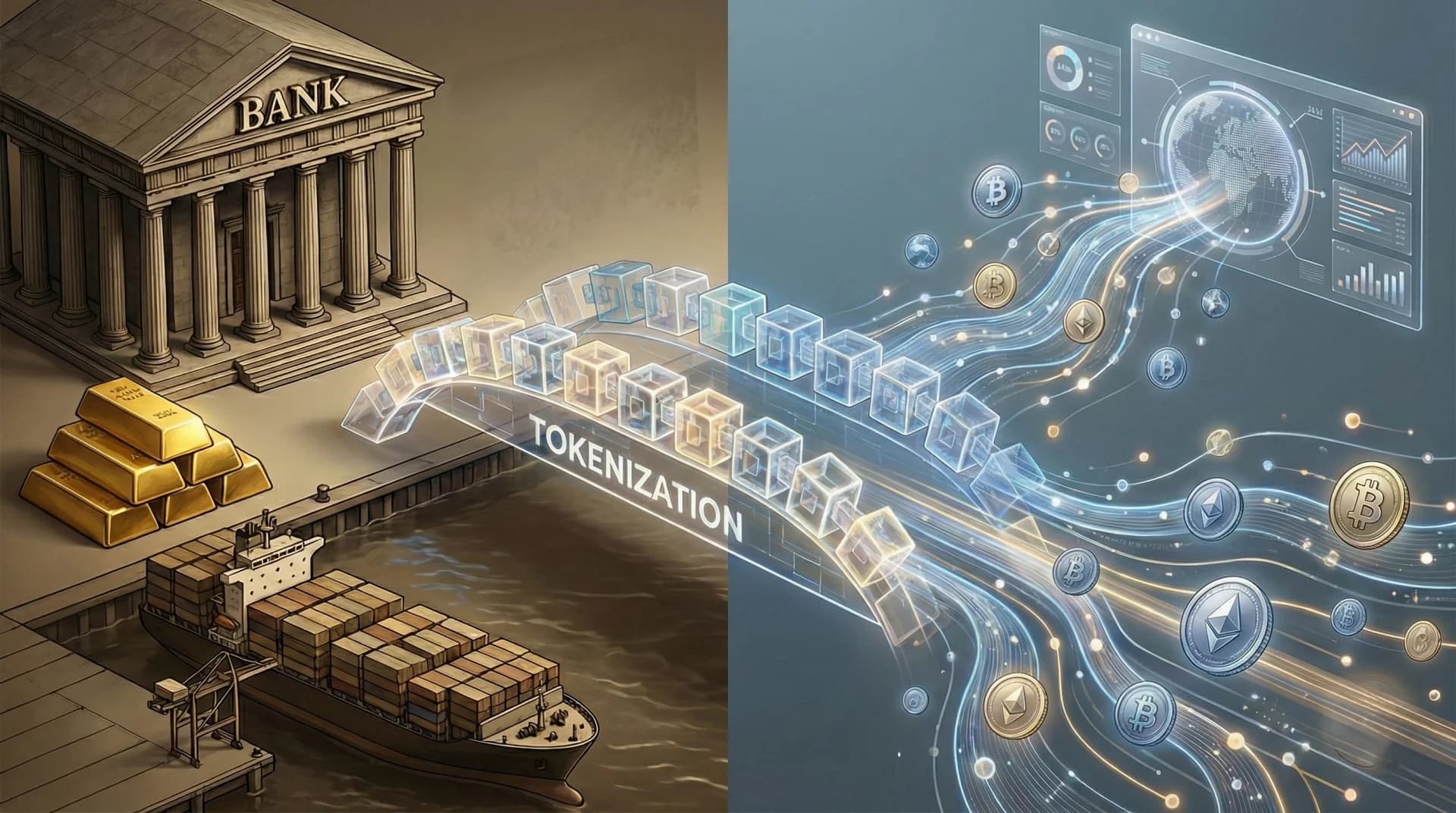

Tokenization is a structural shift in modern markets, allowing physical, financial, and digital assets to become programmable and instantly transferable. By turning traditionally illiquid investments like real estate, intellectual property, or private equity into liquid instruments, tokenization rewires how value moves. This article outlines the five simplest, highest-impact ways this technology unlocks global liquidity and capital efficiency.

Tokenization has become one of the most important breakthroughs in modern digital markets. It allows physical, financial, and digital assets to become programmable, divisible, and instantly transferable. Whether you’re dealing with real estate, credit, IP rights, commodities, or digital collectibles, tokenization rewires how value moves, turning traditionally illiquid assets into liquid, trade-ready instruments.

In a world where capital efficiency and liquidity define market competitiveness, the ability to convert assets into tokens unlocks opportunities that were never possible through legacy financial infrastructure.

Here are the five simplest, highest-impact ways tokenization transforms liquidity across any asset class.

1. Turning Illiquid Assets Into Tradeable Tokens

The foundational benefit of tokenization is the ability to convert static, hard-to-move assets into tokens that can be traded at scale. Instead of requiring full ownership transfers or complex paperwork, tokenized assets allow fractional, programmable ownership.

This opens liquidity across:

- real estate

- private equity

- music royalties

- luxury goods

- carbon credits

- physical art

Even small, historically inaccessible assets become market-ready as tokenized units.

If you’re exploring asset tokenization infrastructure, view our end-to-end token architecture solutions here.

2. Eliminating Friction With Programmable Web Tokens

One of the most underrated advantages of tokenization is the rise of the web token, programmable digital representations of assets that move seamlessly across applications, wallets, and marketplaces.

They reduce liquidity friction by enabling:

- instant settlement

- cross-platform mobility

- automated payouts

- interoperability with DeFi

- real-time ownership updates

Because web tokens operate on decentralized rails, they bypass the delays and restrictions of traditional systems.

3. Improving Market Efficiency Through Data Tokenization

Most teams think tokenization applies only to financial assets, but data tokenization is becoming one of the biggest drivers of enterprise liquidity.

Data tokenization converts sensitive or proprietary datasets into cryptographically protected token models that can be shared, traded, or licensed without exposing raw information.

Data tokenization benefits include:

- privacy-preserving data exchange

- monetizable data marketplaces

- cross-company collaboration without risk

- real-time access with zero exposure

This creates new liquidity pathways for data-rich businesses while keeping privacy intact.

4. Enhancing Liquidity Through Built-In Tokenization Security

Liquidity only matters if the system is secure.

That’s why tokenization security is central to any liquidity strategy. Strong security ensures that tokens representing high-value assets cannot be forged, manipulated, or misappropriated.

A secure tokenized system includes:

- verifiable provenance

- tamper-resistant metadata

- permissioned minting logic

- immutable transaction records

- role-restricted asset management

Security gives investors confidence and confidence unlocks liquidity.

For tokenization security audits and architecture review, check out our smart contract audit services. Book a free consultation today to keep the best security practices for your token.

5. Enabling Instant Access to DeFi Through Clear Crypto Liquidity Pathways

Tokenized assets can participate in global liquidity pools instantly. This is the point where tokenization shifts from being a representation layer to becoming a liquidity engine.

One of the biggest questions founders ask is:

“How is crypto liquidity explained in the context of tokenized markets?”

Here’s the simplest version:

- tokens can be deposited into liquidity pools

- they can be swapped, borrowed, or used as collateral

- they maintain transparent on-chain value

- they create yield, trading opportunities, and instant exit options

This dynamic gives tokenized assets real, global liquidity, something traditional markets cannot match.

FAQ: Tokenization & Liquidity

Q: What types of assets can be tokenized?

A: Nearly anything - real estate, credit, commodities, IP rights, data, and financial instruments.

Q: Is tokenization security important for liquidity?

A: Yes. Strong security increases trust, which directly impacts market liquidity.

Q: Does tokenization reduce transaction time?

A: Significantly. Token transfers settle in seconds, not days.

Q: Can tokenization help enterprises monetize unused assets?

A: Absolutely. Tokenization creates new revenue channels.

Q: Do you need a blockchain to tokenize assets?

A: Yes, blockchains enable verifiable ownership, transferability, and decentralization.

Conclusion

Tokenization is more than a technological upgrade, it is a structural shift in how assets are owned, traded, and liquidated. By reducing friction, improving security, enabling programmable liquidity, and creating new economic models, tokenization unlocks liquidity for any asset class.

Organizations that adopt tokenization early will gain a major advantage in capital efficiency, global accessibility and financial innovation.EthElite helps teams design and deploy tokenization frameworks that are secure, compliant, and built for scale.

Share with your community!